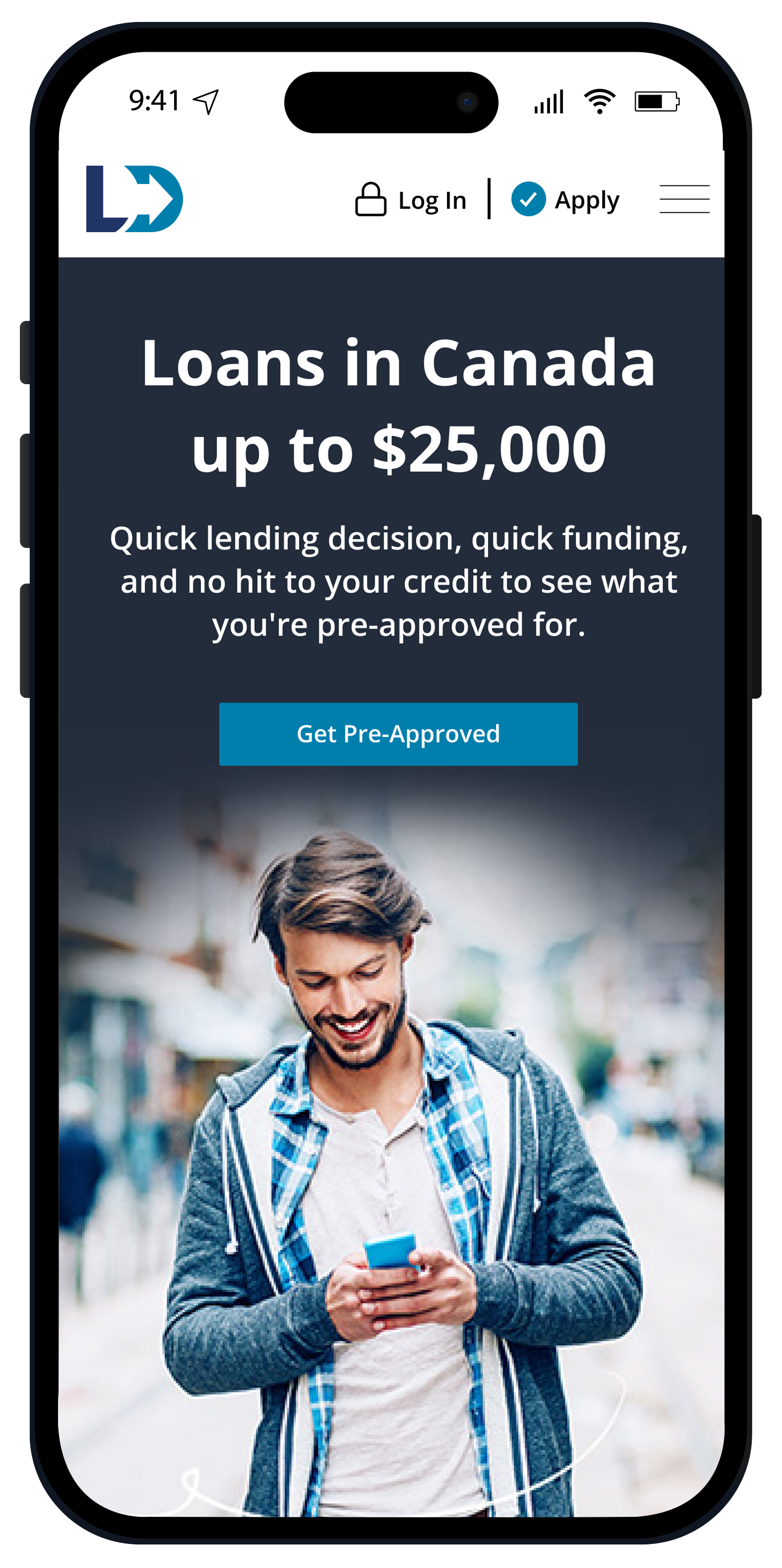

Personal Loans in Canada

Take control of your finances with a personal loan up to $25,000.

Get Pre-Approved§

Loan Protection

Optional Loan Protection could help cover your loan when unexpected life changes or lifetime milestones happen.‡

15 Minute Funding

Receive your money quickly! You could get your funds in as little as 15 minutes with Interac e-Transfer®.+

Account Management

Make payments online or on the LendDirect mobile app.

Our Personal Loans Explained

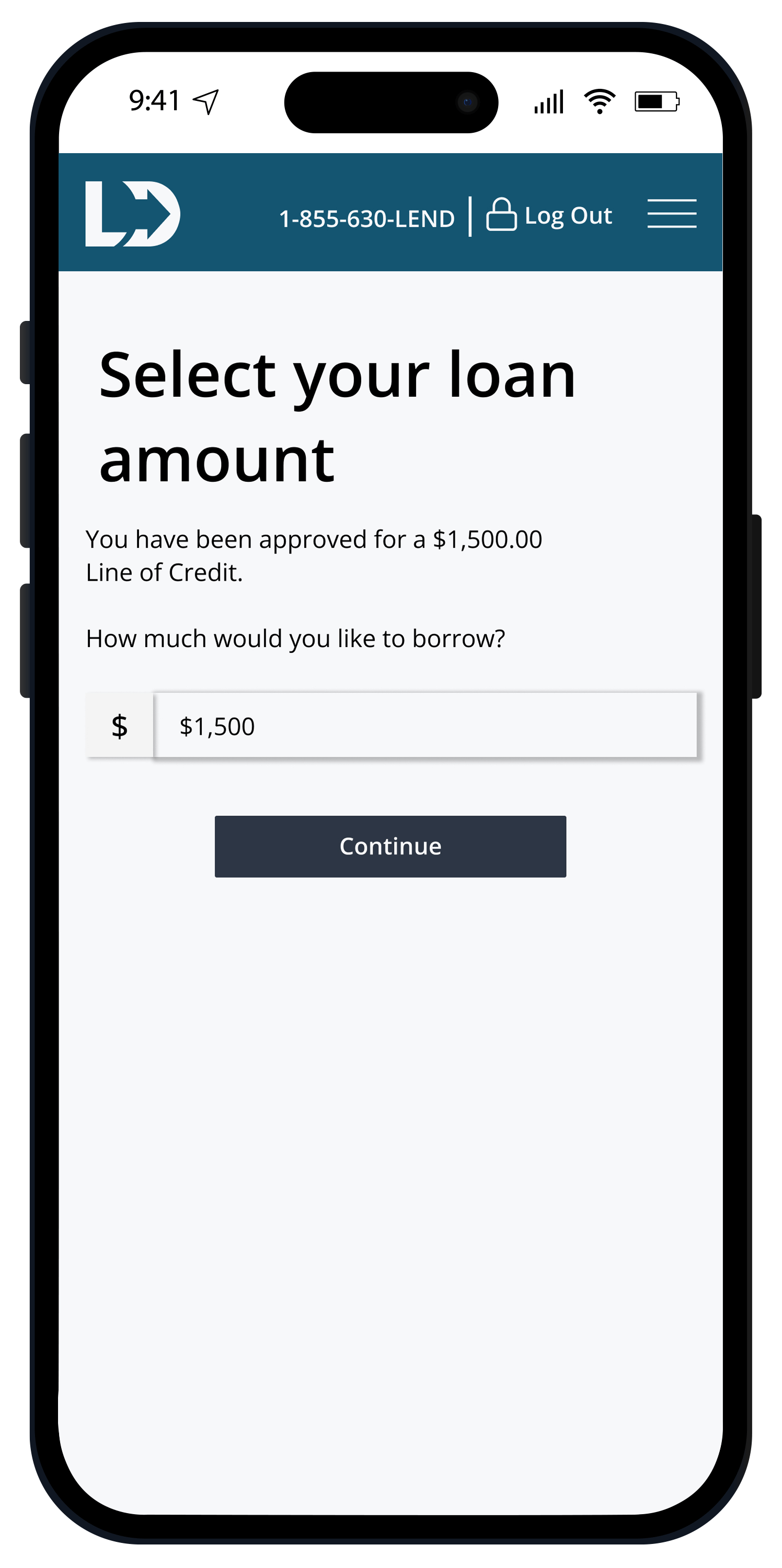

Flexible Lines of Credit

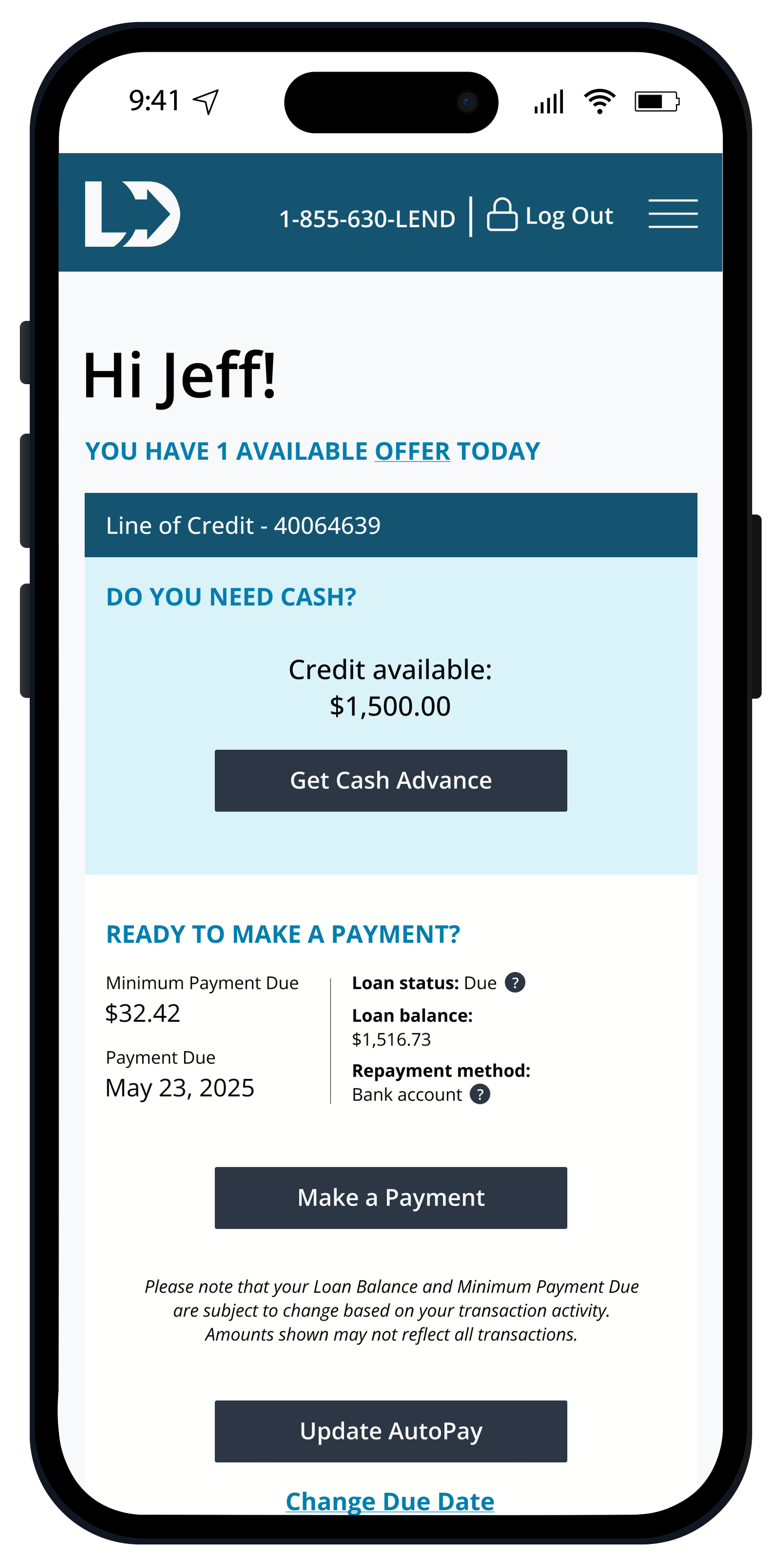

A Line of Credit is a convenient way to borrow. Once approved, you are given access to your credit limit. However, you do not have to borrow all the money at once. You choose how much and when to borrow, then just make payments based on your principal balance and daily interest accrued on what you’ve used. Not the whole loan amount. Plus, enjoy unlimited no-fee advances up to your credit limit.††

Personal Secured Loan

Our Secured Loan is a different kind of personal loan that you can apply for up to $25,000. You may be approved for more money than a Line of Credit and your payments will be scheduled for the same amount each due date. To apply for a Secured Loan, please visit a LendDirect branch with your vehicle and required documentation.

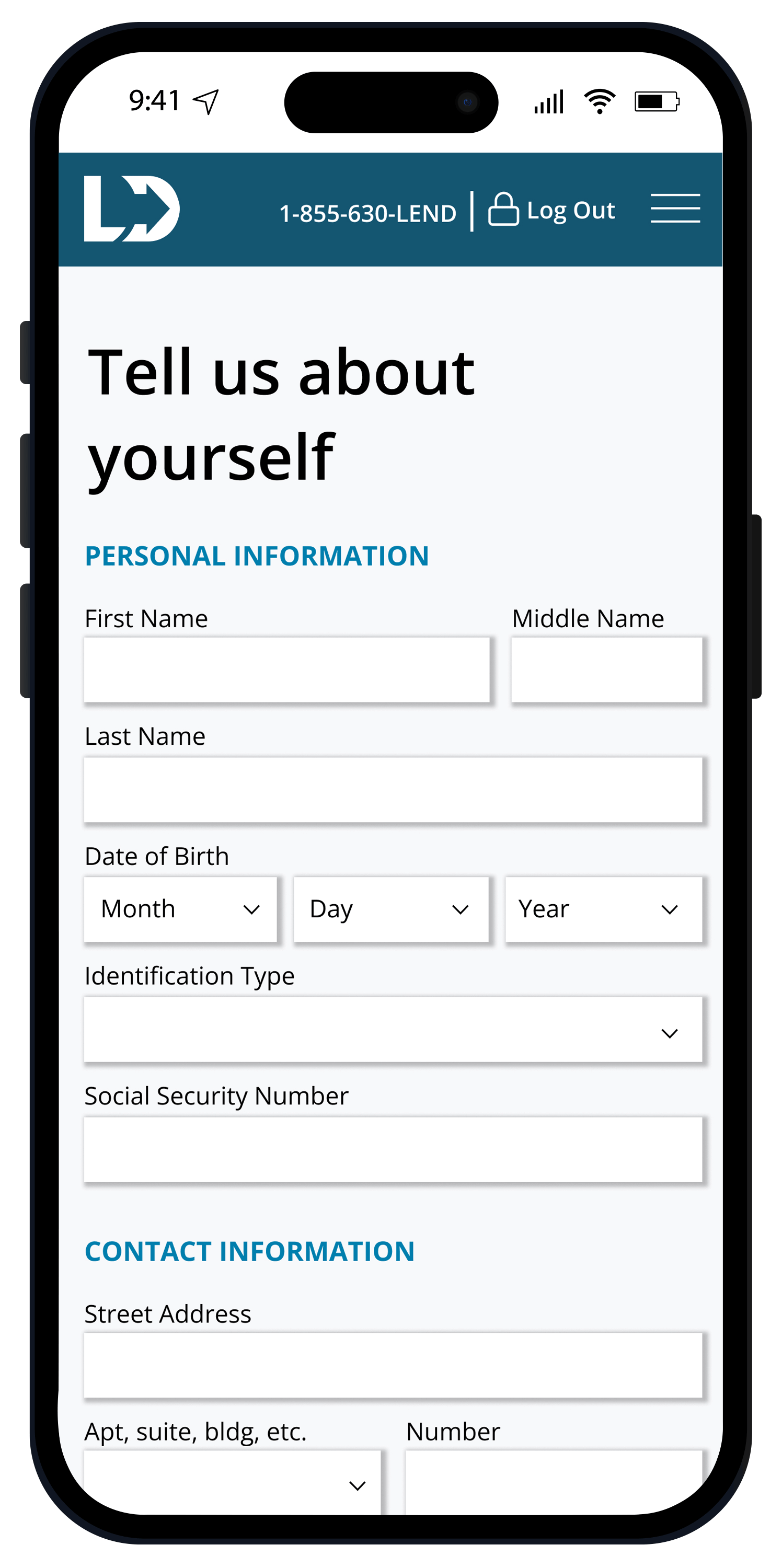

What Do I Need to Apply for a Loan?

Line of Credit

- Age 18 or older

- A valid ID

- An open bank account in your name

- Proof of recurring income

- Be a Canadian resident

- Phone number

Secured Loan

- Age 18 or older

- A valid ID

- An open bank account in your name

- Proof of recurring income

- Be a Canadian resident

- Phone number

- Ownership documentation

- Proof of insurance

- Vehicle on site

Optional Loan Protection Plan

Borrow with reassurance when you enroll in the Loan Protection Plan

At LendDirect, we are proud to serve our Customers for the lifetime of their loans. We understand that life gets busy and can easily send unexpected changes our way.

With the optional Loan Protection Plan, your loan could be covered for unexpected changes like involuntary unemployment, injury or sickness, or even some positive lifetime milestones.

‡Must be 18 years of age or older, and under 70 years of age to be eligible. The optional Loan Protection Plan is a Group Policy underwritten by Canadian Premier Life Insurance Company and Canadian Premier General Insurance Company, operating under the brand name Securian Canada. See Summary of Coverage and Certificate of Insurance for full coverage details including benefits and exclusions.

The LendDirect Application Process

1

Apply Your Way

Apply online, by phone, or at a branch.

Secured Loans are only available at a branch.

2

Submit Your Information

Provide the required documents. Get a quick lending decision and review the documentation. Once approved, sign your loan agreement.

3

Get Your Money

Use Interac e-Transfer® electronic funding or direct deposit to your bank account.

4

Manage Your Account

Easily keep track of your account online (or in our LendDirect mobile app)!

Frequently Asked Questions About Personal Loans

You can easily apply online, by phone, or at a branch for a personal Line of Credit. To find your closest branch, visit our Branch Locator page. To apply for a personal Secured Loan, please come see us at a branch location.