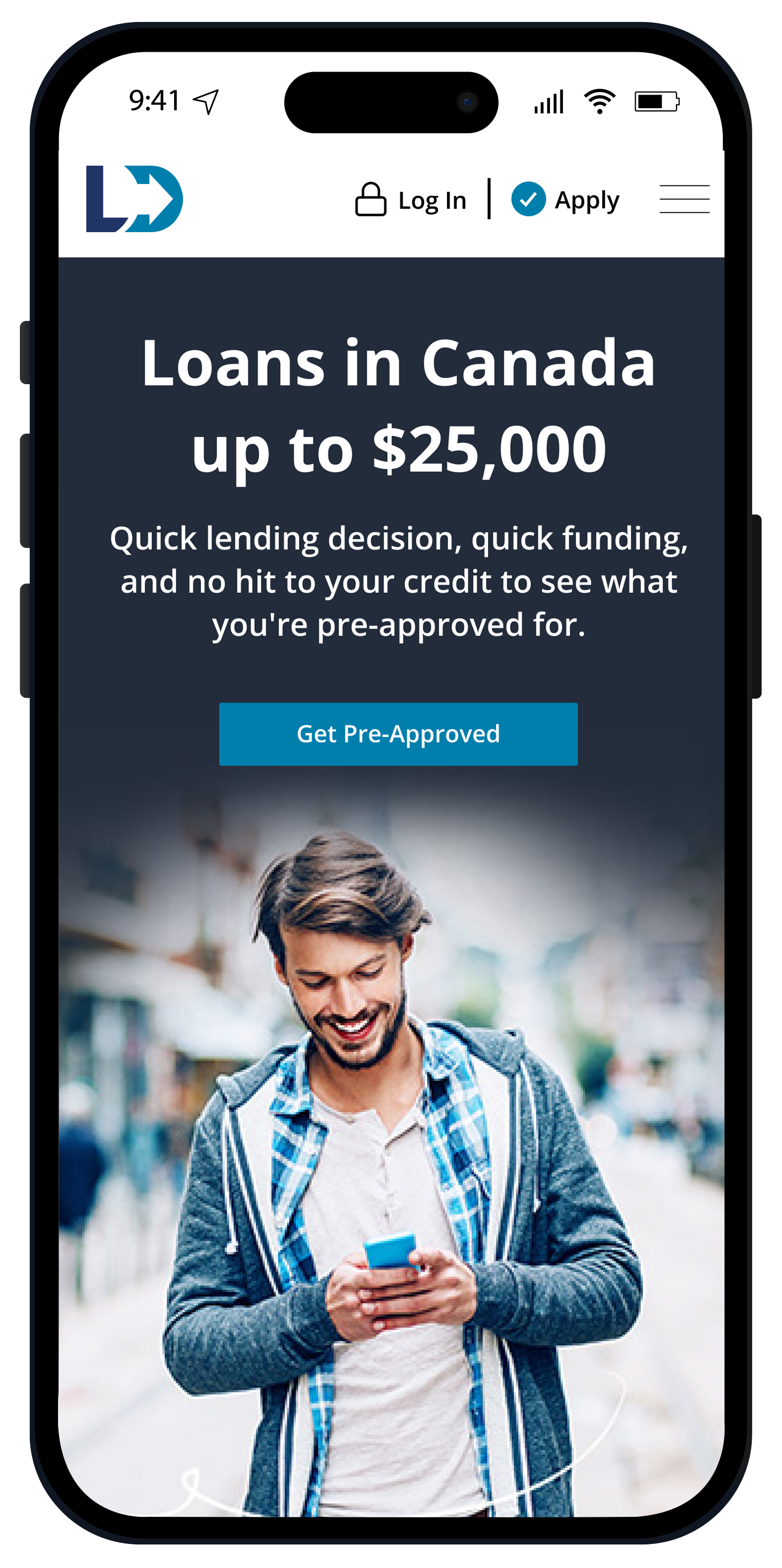

Need to Borrow Money in Canada?

Select your province or territory from the dropdown below for more information about the loans we offer in your area.

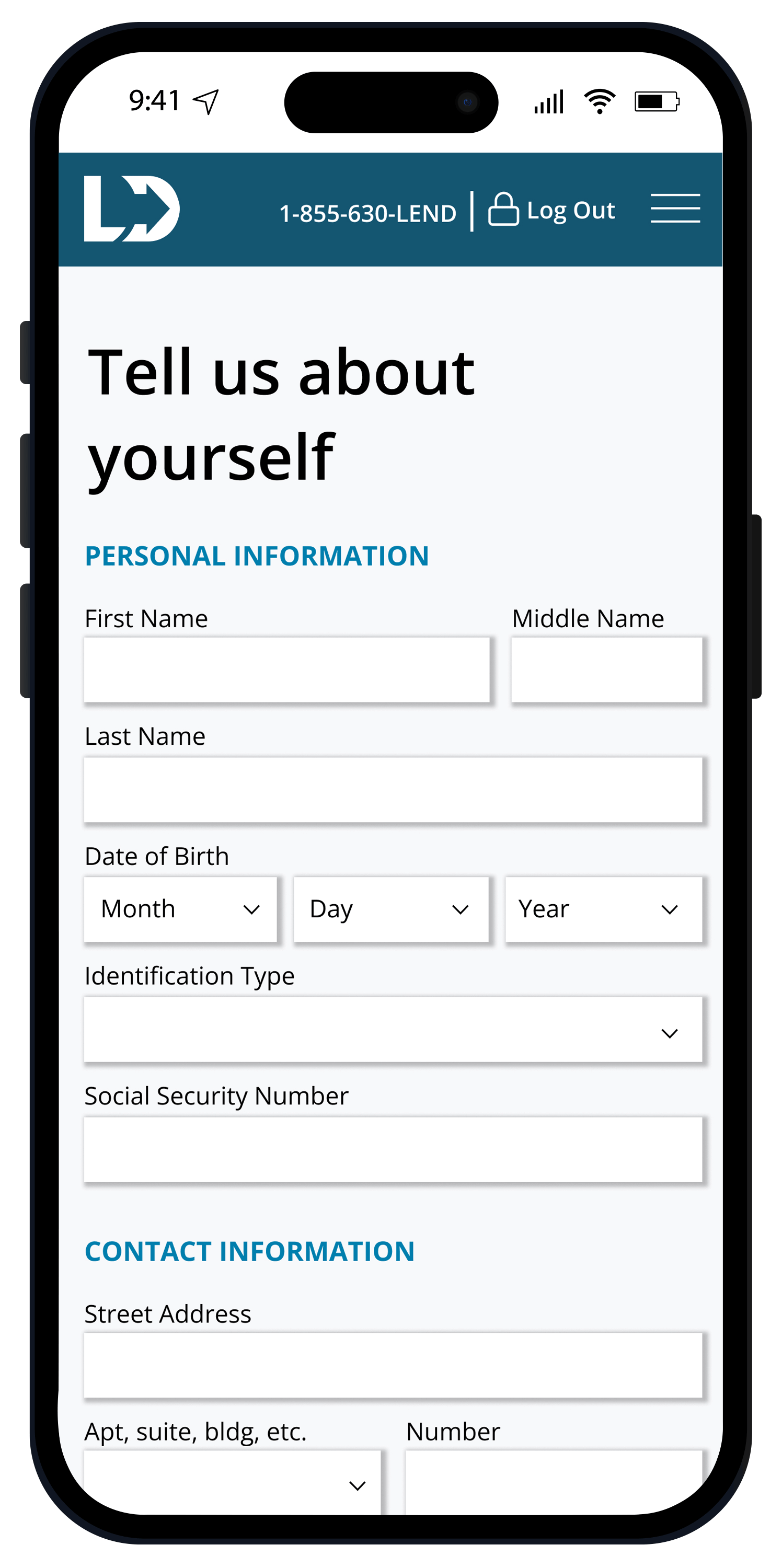

What Do I Need to Start My Online Application?

Line of Credit

- Age 18 or older

- A valid ID

- An open bank account in your name

- Proof of recurring income

- Be a Canadian resident

- Phone number

Secured Loan

- Age 18 or older

- A valid ID

- An open bank account in your name

- Proof of recurring income

- Be a Canadian resident

- Phone number

- Ownership documentation

- Proof of insurance

- Vehicle on site

We Have Your Back

Our online application is encrypted for security. Have questions? You can contact us at 1-855-630-5363!

Apply NowHow It Works

1

Apply Your Way

Apply online, by phone, or at a branch.

Secured Loans are only available at a branch.

2

Submit Your Information

Provide the required documents. Get a quick lending decision and review the documentation. Once approved, sign your loan agreement.

3

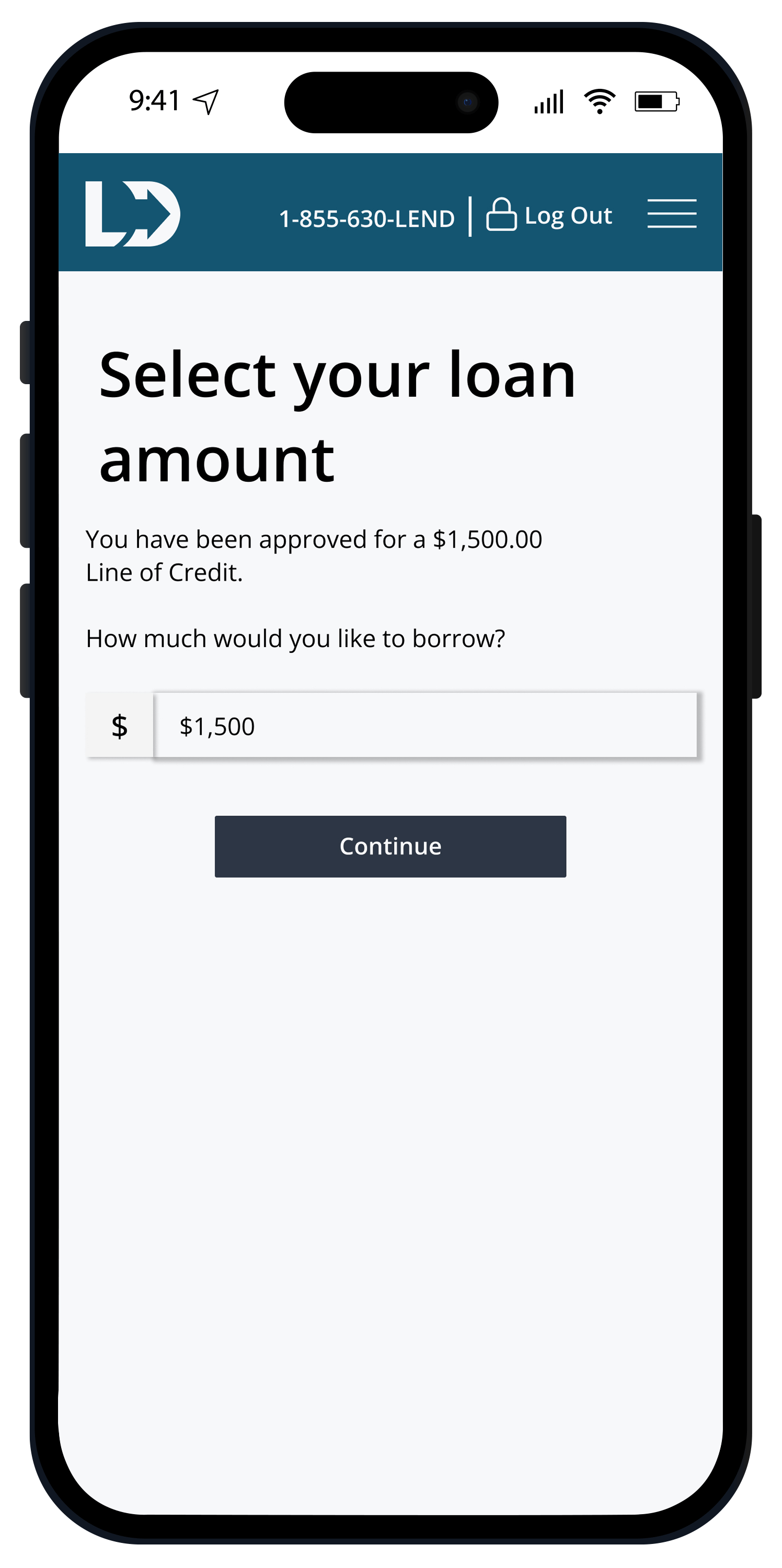

Get Your Money

Use Interac e-Transfer® electronic funding or direct deposit to your bank account.

4

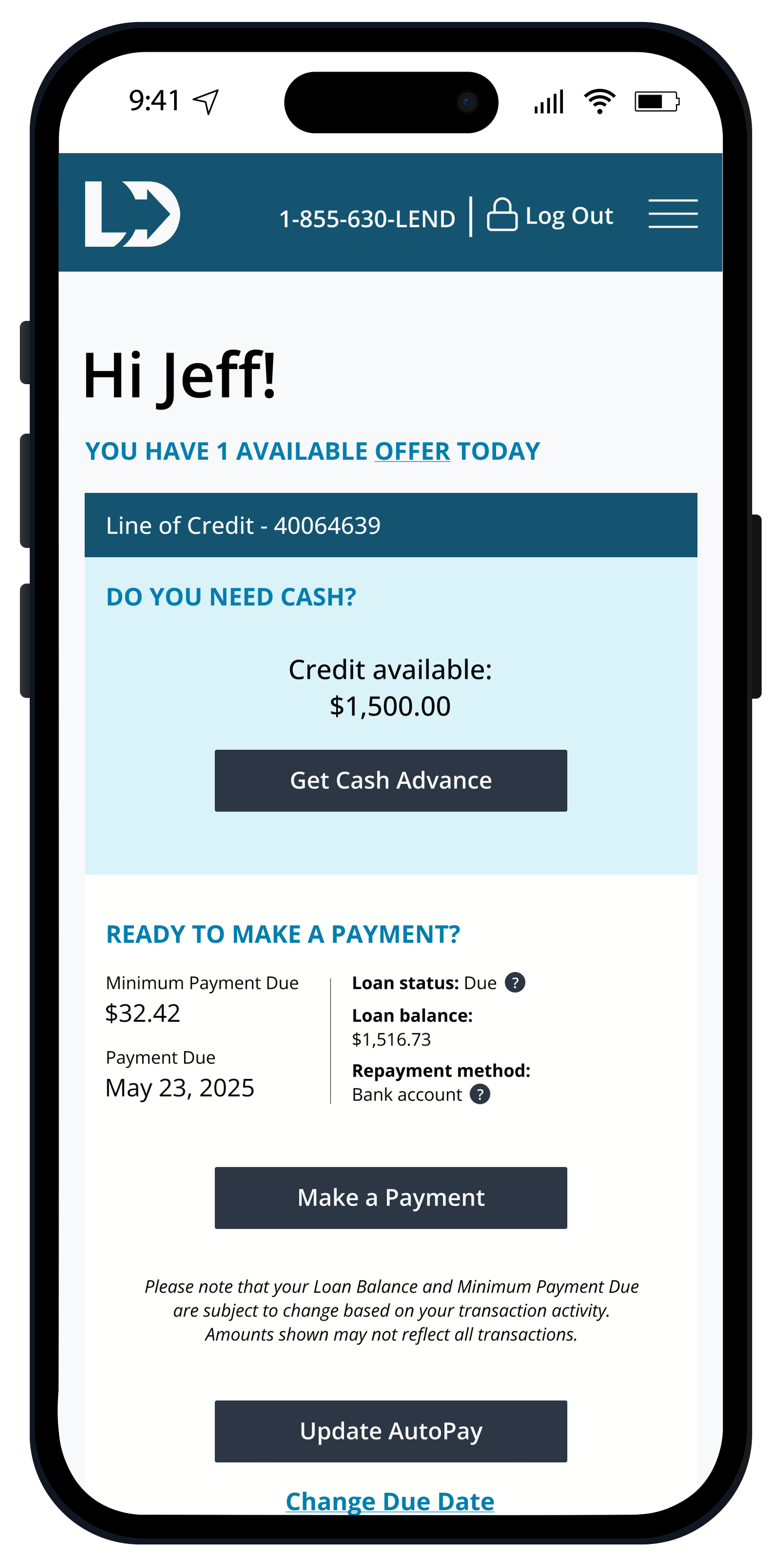

Manage Your Account

Easily keep track of your account online (or in our LendDirect mobile app)!

Looking for More Answers?

Read our FAQs or visit our Security Centre.

You can apply for up to $10,000. You can easily discover how much you are pre-approved for without affecting your credit score.§ Get pre-approved today!

Our Secured Loan is a personal loan backed by your vehicle, so it can be used for lots of things! If you need to bridge a financial gap, make auto or home repairs, upgrade technology, invest in education, or pay bills, a Secured Loan could help you with these things and more.

With a Secured Loan, you can apply for up to $25,000. You can easily discover how much you are pre-approved for without affecting your credit score.§ Secured Loans are only available at branch locations, so gather the required information to get pre-approved today!