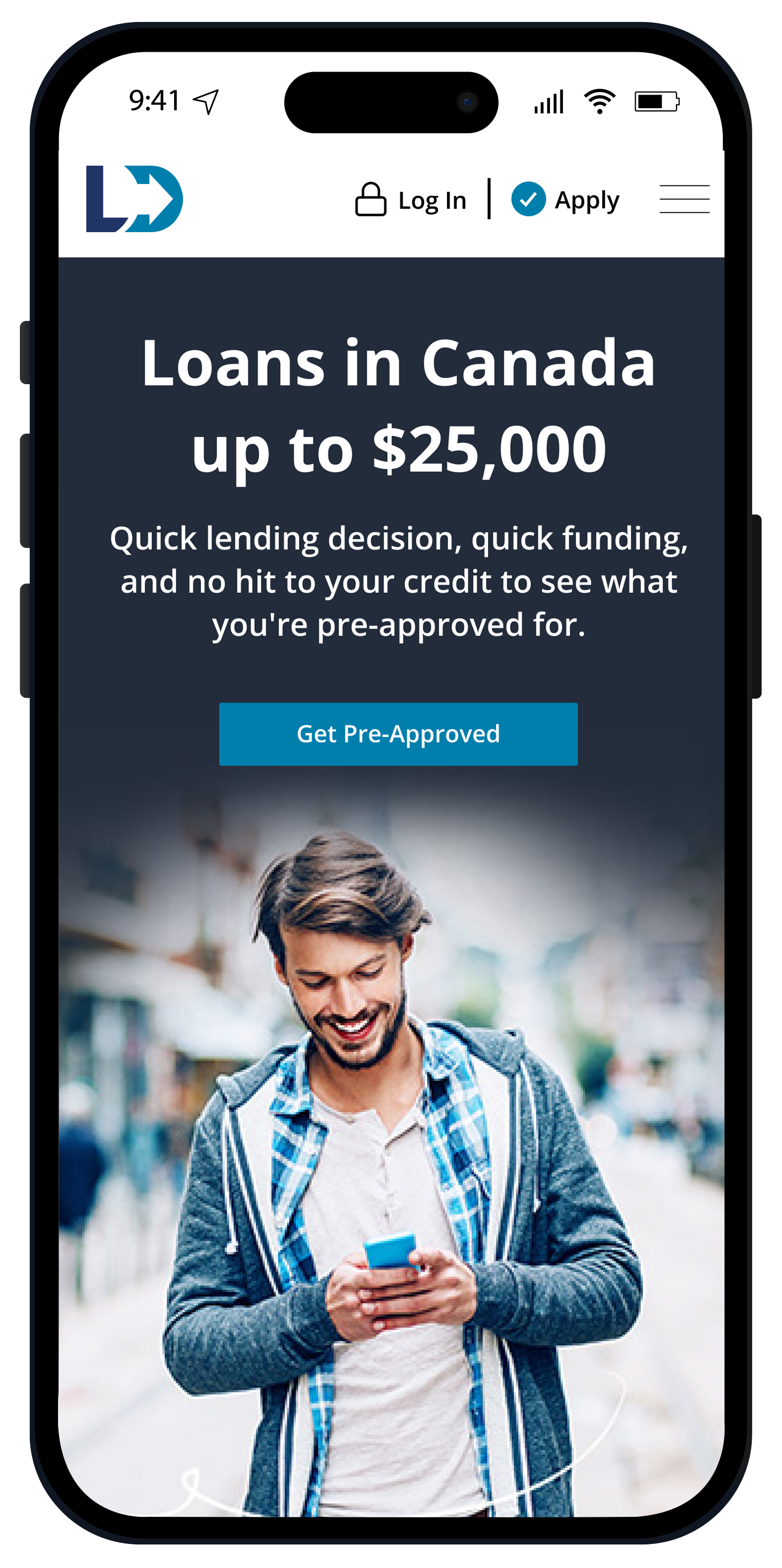

Online Loans Tailored to Your Needs

Apply for a LendDirect personal loan anywhere, anytime.

Get Pre-Approved§

How Online Loans Work

With LendDirect, you can apply online for your personal loan from almost anywhere.

Start Your Application

Conveniently submit your online application at home or on-the-go!

Quick Lending Decision

Sometimes you don't have time to wait, and we get that! We're dedicated to giving you a loan decision typically within minutes.

15 Minute Funding Available

Once approved, receive your money via Interac e-Transfer® in as little as 15 minutes.+

Why LendDirect?

Personal Loans with Terms for Your Needs

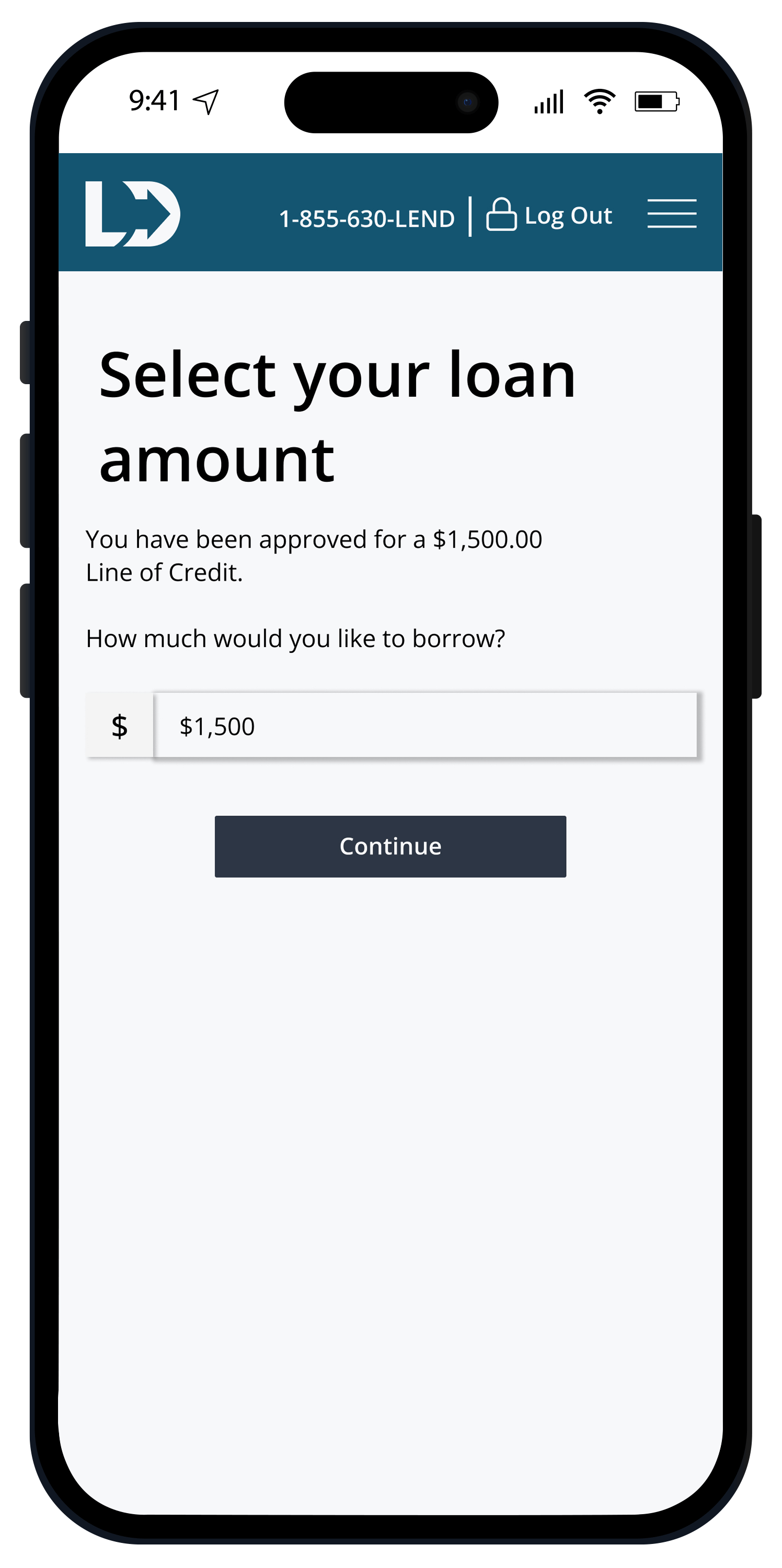

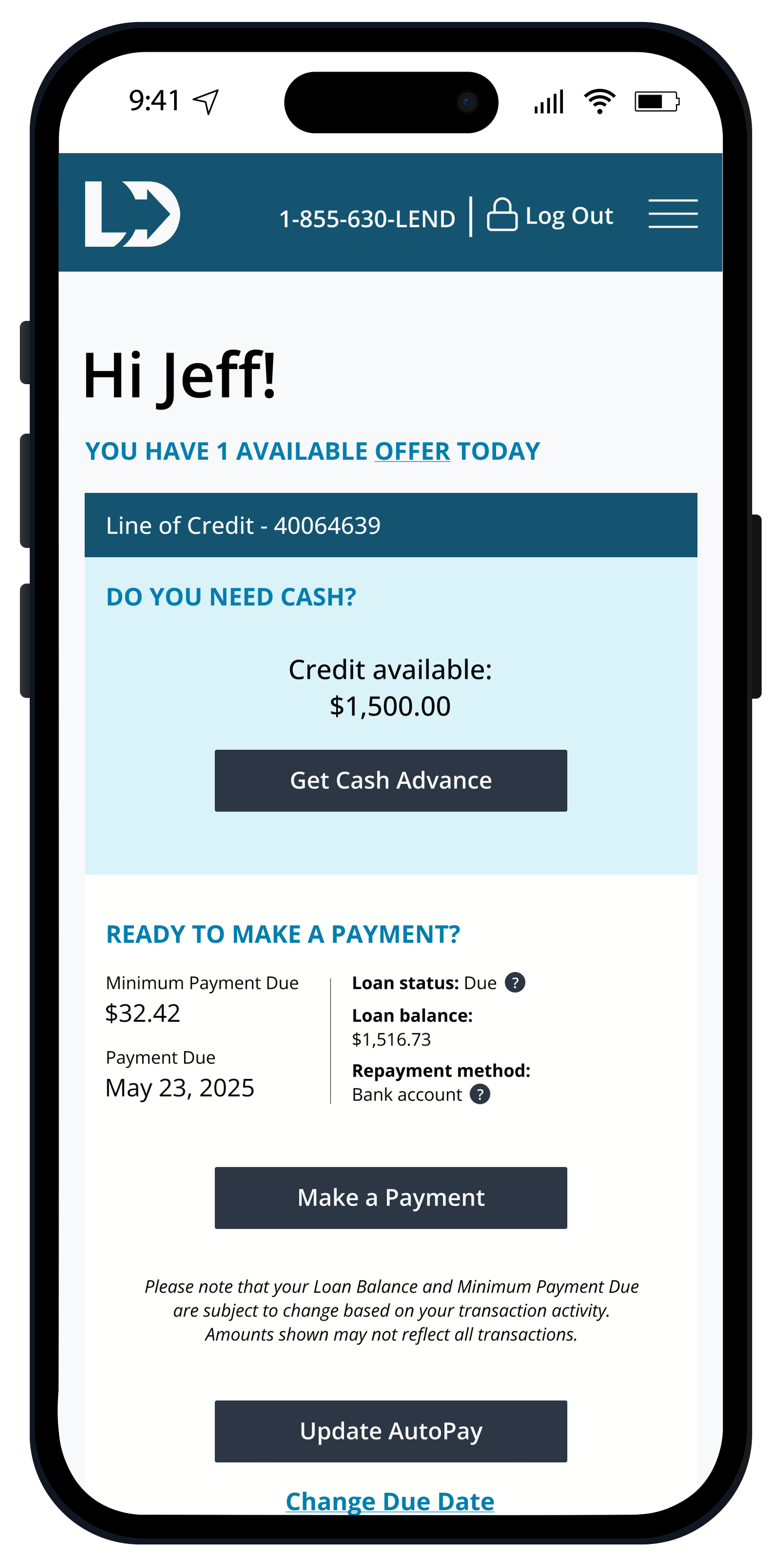

LendDirect offers two personal loan options. However, our Line of Credit is currently the only loan offered online. With a Line of Credit, your loan stays open as long as you need it. If you need more money, you can request an unlimited amount of no-fee advances up to your approved credit limit.††

Loan Protection with More

Borrow with peace of mind. Whether you experience a sickness, injury, involuntary unemployment, critical illness or even a positive lifetime milestone like the birth of a child, the optional Loan Protection Plan could help you make your payments.‡

We're Ready to Help

If you have questions or need assistance, your Home Branch is staffed with knowledgeable and friendly representatives who are happy to walk you through the loan process. Visit your LendDirect Home Branch or give them a call.

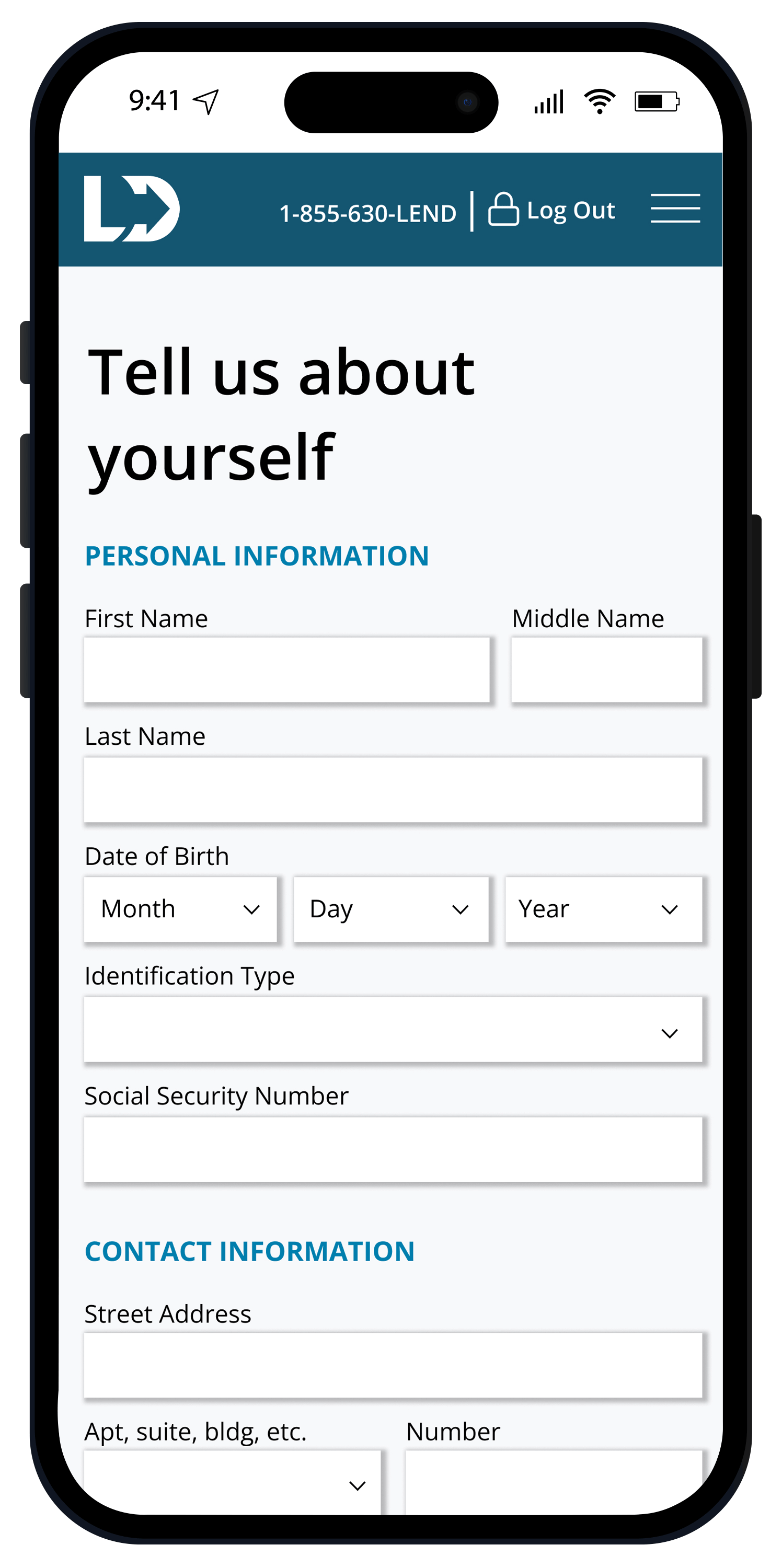

What Do I Need to Apply for a Online Loan?

- Age 18 or older

- A valid ID

- An open bank account in your name

- Proof of recurring income

- Be a Canadian resident

- Phone number

Optional Loan Protection Plan

Borrow with reassurance when you enroll in the Loan Protection Plan

At LendDirect, we are proud to serve our Customers for the lifetime of their loans. We understand that life gets busy and can easily send unexpected changes our way.

With the optional Loan Protection Plan, your loan could be covered for unexpected changes like involuntary unemployment, injury or sickness, or even some positive lifetime milestones.

‡Must be 18 years of age or older, and under 70 years of age to be eligible. The optional Loan Protection Plan is a Group Policy underwritten by Canadian Premier Life Insurance Company and Canadian Premier General Insurance Company, operating under the brand name Securian Canada. See Summary of Coverage and Certificate of Insurance for full coverage details including benefits and exclusions.

How to Apply for an Online Loan at LendDirect

Use your mobile phone, computer, or other device to apply completely online.

1

Apply Your Way

Apply online, by phone, or at a branch.

Secured Loans are only available at a branch.

2

Submit Your Information

Provide the required documents. Get a quick lending decision and review the documentation. Once approved, sign your loan agreement.

3

Get Your Money

Use Interac e-Transfer® electronic funding or direct deposit to your bank account.

4

Manage Your Account

Easily keep track of your account online (or in our LendDirect mobile app)!

Online Loan Frequently Asked Questions

You can apply for up to $10,000. You can easily discover how much you are pre-approved for without affecting your credit score.§ Get pre-approved today!

With a Secured Loan, you can apply for up to $25,000. You can easily discover how much you are pre-approved for without affecting your credit score.§ Secured Loans are only available at branch locations, so gather the required information to get pre-approved today!

We offer electronic funding options to receive your money. You can choose to get your funds in as little as 15 minutes via Interac e-Transfer®. Or have your money direct deposited into your bank account, timing depends on your banking institution.